May 10, 2022

TerraUSD Faces First Stress Test Amid Market Storm

Dear Secret BTC Agent,

All hands are on deck right now over at Terraform Labs, the team behind the Terra (LUNA, Tech/Adoption Grade "D") network.

That's because its stablecoin, TerraUSD (UST), lost its peg to the U.S. dollar yesterday for the second time in 48 hours.

The stablecoin, which is designed to remain fixed in value to $1, first fell briefly to 98 cents on Saturday before rebounding. Then, investors watched in a panic as the coin fell as low as 65 cents on Monday as significant downside pressure impacted assets across the crypto spectrum.

How It Happened

UST is the largest decentralized stablecoin. It's also the largest algorithmic stablecoin — one that relies on an algorithm to balance its peg rather than a full reserve to back it.

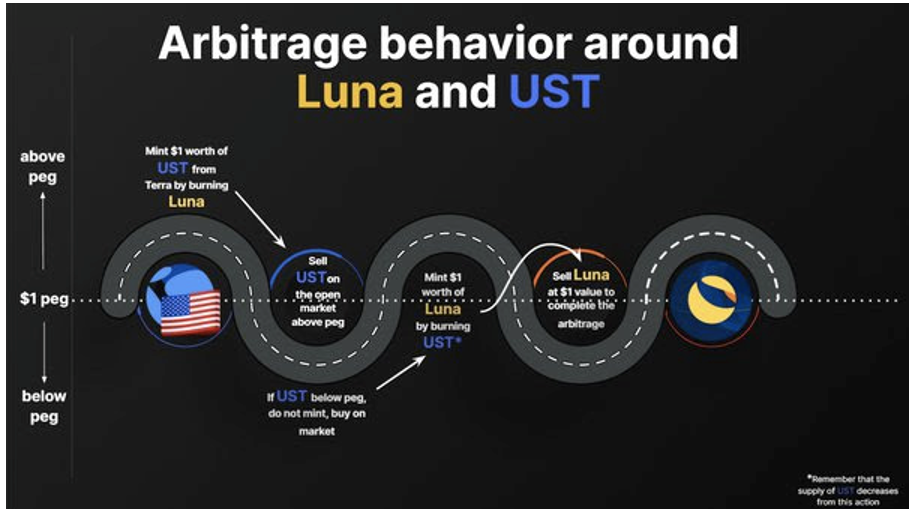

How this algorithm works is that it burns Terra's native token, LUNA, in order to mint new UST tokens. That makes LUNA deflationary — which is good for a variable-price coin — and means that LUNA is used to back UST.

If there's too much UST in circulation that would devalue the stablecoin, tokens are burned to mint new LUNA.

So, how was UST able to depeg from the dollar if the algorithm is supposed to protect it?

There were a few compounding factors at play.

First was the significant downside pressure LUNA faced over the past few days. In fact, just yesterday, it fell by roughly 48%. That put LUNA's market cap below that of UST's … a significant change that will come into play in a moment.

Next is the fact that yield farmers — drawn to UST due to its price stability and potential for high yields when staked on DeFi platforms — began withdrawing their UST deposits and looking to cash out. Likely, many were trying to offset losses as many assets in the broad market suffered.

And that's where the market caps come back into play. See, demand for UST has skyrocketed thanks to lending platforms like Anchor Protocol, which offer near 20% yields to UST lenders. Circulation of UST has increased from $2 billion to a high of $18.5 billion in a year.

So far, LUNA has been able to support this growth.

But as depositors tried to cash out their UST — with $2.8 billion coming from Anchor alone — they created a bank run on LUNA. And since LUNA's market cap was lower than UST's, it destabilized the entire system.

There was also a "coordinated attack" led by a single wallet that sold $192 million worth of UST, presumably in an effort to prove a theory that the stablecoin cannot hold its peg.

Rescue Plan

People foresaw the potential for a depegging event like this. That's why Terraform Labs had taken action over the recent months to establish the Luna Guard Foundation. The goal was to shore up the reserves, leading them to amass $3.5 billion in Bitcoin reserves as a backup to protect that peg.

The result? Luna Guard Foundation is now lending out $1.5 billion of that reserve to protect the peg. And as of the time of writing, it appears to be working.

But now the entire mechanism behind UST is in question. And that has serious implications.

Many investors have breathed a sigh of relief that the Luna Guard Foundation has decided to loan outits Bitcoin, rather than sell it. The latter option would have released an impressive amount of BTC back into the market … at a time when there's already significant downside pressure.

So luckily, that fear has been put to bed for now.

But still ahead could be additional regulation. Treasury Secretary Janet Yellen focused on UST in the latest Senate Banking Committee hearing, calling for an appropriate framework to oversee stablecoins like UST.

What's Next

All involved in crypto will have an eye on how this situation develops. But one thing is for certain: As the U.S. dollar is poised to face increasing devaluation as years of excess money printing come home to roost — the desire for a truly successful decentralized stablecoin will only increase.

Despite this week's turmoil in both the price of the TerraUSD stablecoin and Terra's native LUNA token, the Terra project still has the potential to survive the calamity.

But if it does, it will be the first of its kind to do so. No algorithmic stablecoin has so far succeeded.

In our view, the pressure on the Terra network is likely to have more to do with the overall market decline and difficulties in the macro environment than Terra's underlying technology.

For now, the best course of action is to avoid making emotional decisions and to keep an eye on the price and the situation as it unfolds.

For that, keep checking in with us here at Weiss Crypto Daily.

Best,

Henry Bond

Guest Contributor

.jpg )

.jpg )

.jpg )

.jpg )

.jpg )